The Analyst

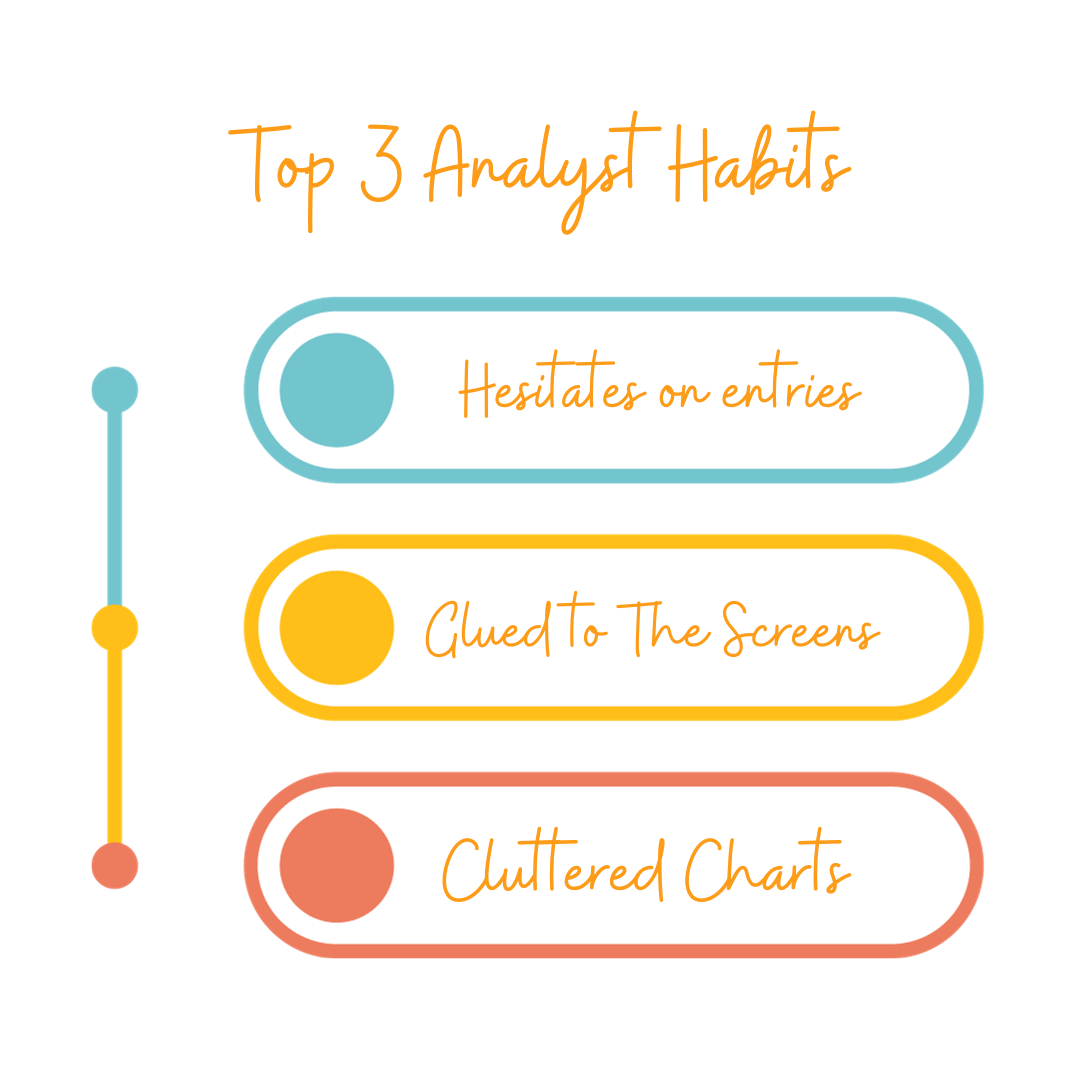

You often second guess yourself, which can cause you to miss many solid trade entries. Too many variables to consider, multiple strategies and indicators to keep track of... your mind is in overdrive.

One of your biggest struggles is lacking confidence in one strategy. The power of simplicity scares you...which is why you go for the more complicated strategies and your chart often resembles a circus.

If I had to guess you also like to track multiple stocks at once, you can never just stay on 1-2 stocks at a time for fear of missing out on the other 8-10.

You also rarely allow yourself a break from the screens, always watching like a hawk.. scared you will miss the one clue that will give you the green light for an a+ trade.

Some of these perfectionist driven habits are actually preventing you from succeeding, yet most traders rarely take a step back from the charts to analyze what really matters, you.

Let's dive more into your weak spots now.

Knowing your weaknesses is actually the key to unlocking your greatest potential.

AKA your greatest potential for improvement.

Weak Spot: You are researching too many trading strategies at once, without ever giving one of them a chance to prove if it works or not. You need a solid 30 days of data to prove this.

Solution: Go back to the very basics, chose a SIMPLE trading strategy you can easily follow and ONLY follow that one strategy for 30 days. You need to declutter your mind so starting here should help.

Weak Spot: You get overwhelmed with trying to look at multiple stocks every day, and if you trade something like options that makes it even worse to consider all the variables, greeks/strike prices

Solution: Aside from simplifying your strategy, you also need to simplify your watchlist. I would trade no more than 2 stocks at a time, for example I trade futures and so daily I track /es and /gc which is gold. Pick 2 that have daily movement you can easily track. Consistency is going to be key for you.